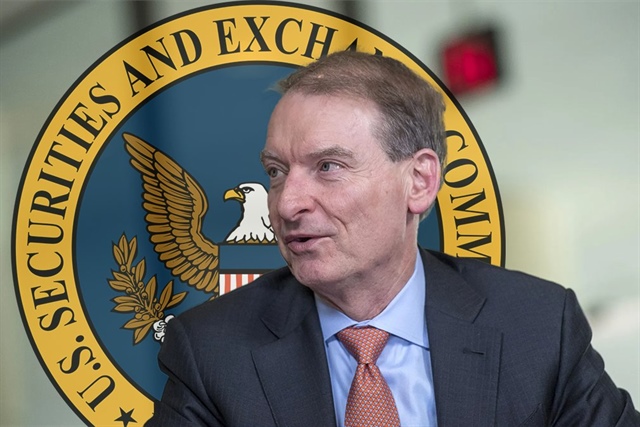

On April 23, 2025, the SEC sues PGI Global CEO, accusing Ramil Palafox, founder of PGI Global, of masterminding a $198 million Ponzi scheme that defrauded over 30,000 investors worldwide. The U.S. Securities and Exchange Commission claims Palafox misled investors with false promises of high returns through AI-driven trading in cryptocurrency and foreign exchange, diverting funds for personal luxuries and paying earlier investors with new contributions. As the first major fraud case under SEC Chair Paul Atkins, this lawsuit signals heightened scrutiny in the crypto industry. This article explores why the SEC sues PGI Global CEO, the allegations, and their impact on investors and the crypto market.

Why SEC Sues PGI Global CEO

The SEC Targets PGI Global CEO for orchestrating a Ponzi scheme that exploited investors globally. Filed on April 22, 2025, the SEC’s complaint alleges that from 2020 to 2022, Palafox collected $198 million by promoting AI-based crypto trading and forex opportunities with guaranteed 10–20% monthly returns. Instead, he misappropriated funds for personal expenses, including luxury cars, real estate, and private jet travel, while using new investor money to pay fake returns, a classic Ponzi tactic.

The SEC asserts Palafox violated securities laws by falsifying trading results and misrepresenting PGI Global’s operations. Industry discussions reveal shock among investors, many unaware of the fraud until PGI Global collapsed in 2022. The SEC sues PGI Global CEO to hold Palafox accountable, reflecting Atkins’ commitment to combating crypto fraud and protecting investors.

Details of the Alleged Ponzi Scheme

The SEC sues PGI Global CEO for a scheme targeting retail investors across the U.S., Asia, and Africa. Palafox marketed PGI Global through social media and referral programs, incentivizing recruitment with bonuses. The SEC alleges the AI trading platform was a sham, with minimal funds used for trading. Of the $198 million raised, Palafox spent millions on a $3 million mansion, a Lamborghini, and other extravagances.

PGI Global employed multi-level marketing to expand, promising passive income to lure investors. When the scheme failed, investors lost access to their funds, prompting regulatory action. The SEC seeks to recover losses, impose penalties, and bar Palafox from future securities offerings to restore confidence in the crypto market.

Implications for the Crypto Industry

The SEC sues PGI Global CEO action highlights the persistent threat of crypto fraud. Ponzi schemes exploit investor trust, causing significant financial harm. This case underscores the need for due diligence, as crypto scams remain a global issue. Under Atkins, the SEC is intensifying efforts to protect investors, potentially accelerating regulatory frameworks for digital assets.

The lawsuit exposes vulnerabilities where AI-driven profit promises conceal fraud. Exchanges may face stricter compliance requirements to prevent similar schemes. While the case could deter fraudsters, overly stringent regulations risk stifling legitimate blockchain innovation, impacting DeFi and Web3 development.

Opportunities for Investor Education

The SEC sues PGI Global CEO case offers a chance to enhance investor education. Retail investors can learn to spot red flags, such as guaranteed high returns or multi-level marketing models. Resources on crypto fundamentals and risk management help investors evaluate trading platforms. Blockchain transparency enables tracking on-chain activity, empowering investors to detect suspicious patterns.

Using reputable exchanges and consulting financial advisors can safeguard investors. The case aligns with Web3 principles of decentralized trust, encouraging reliance on verified platforms over unproven schemes.

Challenges in Tackling Crypto Fraud

The SEC Targets PGI Global CEO lawsuit reveals challenges in combating crypto fraud. Global jurisdictions complicate enforcement, as Palafox operated across multiple regions. Crypto’s pseudonymous nature can shield fraudsters, hindering investigations. Regulatory gaps in DeFi allow scams to proliferate, with AI-driven frauds increasingly elusive.

Retail investors need better education to navigate crypto complexity, as many lack the skills to assess platforms. Exchanges must balance privacy with compliance, while regulators adapt to blockchain’s rapid evolution without hampering innovation.

Looking Ahead for SEC Sues PGI Global CEO

As the SEC Accuses PGI Global CEO, the crypto industry anticipates stronger oversight. The case may spur U.S. crypto regulations, complementing frameworks like MiCA in the EU. Investors should prioritize transparency, using blockchain analytics to vet projects. With global crypto adoption growing, this lawsuit calls for enhanced education and regulation, ensuring blockchain’s potential thrives securely.