MilkyWay is reshaping the landscape of decentralized finance with its powerful modular liquid staking protocol, fueled by its native token, $MILK. As of April 29th, the MilkyWay Chain stands secured by $MILK, powering transactions, gas fees, security, and liquidity across its innovative ecosystem. In this article, we dive deep into MilkyWay, the purpose behind $MILK, and how its tokenomics drive sustainable, long-term growth for early adopters and investors.

Table of Contents

- Introducing MilkyWay

- Understanding $MILK and Its Importance

- In-Depth $MILK Tokenomics Analysis

- $MILK Vesting and Release Strategy

- Challenges and Future Potential

- Conclusion: The Value of MilkyWay and $MILK

Introducing MilkyWay

MilkyWay is a groundbreaking modular blockchain protocol revolutionizing decentralized finance through its advanced liquid staking framework. Designed to integrate seamlessly with rollups and off-chain services, MilkyWay delivers unified decentralized trust by offering scalable, composable staking solutions that surpass the limitations of traditional blockchains. Its modular architecture enhances flexibility, security, and efficiency, enabling developers and users to engage with dynamic decentralized ecosystems.

Understanding $MILK and Its Importance

The $MILK token serves as the backbone of the MilkyWay Chain, powering its operations starting April 29, 2025. $MILK fulfills several critical roles:

- Strengthening network security

- Enabling smooth transaction processing

- Covering gas fees for on-chain interactions

- Supporting liquidity for ecosystem activities

More than a technical utility, $MILK drives economic incentives, aligning the interests of community participants, developers, and strategic partners to fuel MilkyWay’s growth.

In-Depth $MILK Tokenomics Analysis

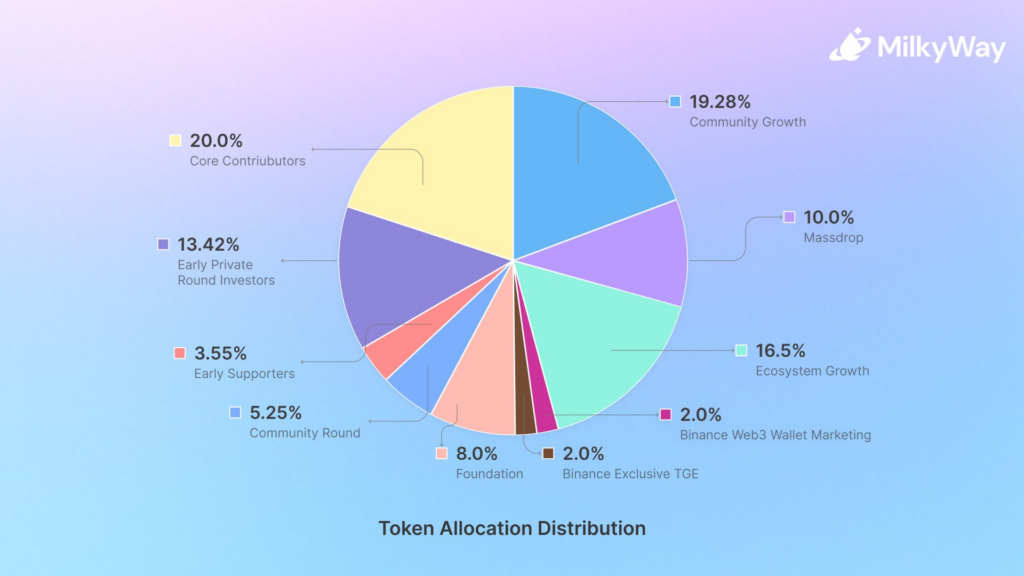

The $MILK token has a total initial supply of 1,000,000,000, with a distribution model crafted to ensure long-term ecosystem sustainability. The allocations are structured as follows:

Core Allocations

- Core Contributors (20%): 200M $MILK, locked for 12 months, vesting linearly over 36 months.

- Early Private Round Investors (13.42%): 134.2M $MILK, subject to a similar vesting schedule.

- Early Supporters (3.55%): 35.5M $MILK allocated to early builders and advisors.

- Foundation (8%): 80M $MILK for DeFi integrations and strategic growth efforts.

- Community Round (5.25%): 52.5M $MILK to foster early community involvement.

- Binance Exclusive TGE (2%): 20M $MILK, fully unlocked at launch.

- Binance Web3 Wallet Marketing (2%): 20M $MILK for promotional initiatives.

- Ecosystem Growth (16.5%): 165M $MILK for AVS integration, rollup incentives, and grants.

- Massdrop (10%): 100M $MILK for early users and testers, unlocking over 12 months.

- Community Growth (19.28%): 192.8M $MILK for partnerships, campaigns, and incentives.

This strategic allocation ensures MilkyWay supports both its core team and broader community, fostering balanced ecosystem development.

$MILK Vesting and Release Strategy

MilkyWay implements a carefully designed vesting plan to promote stability:

- Monthly or linear token releases to avoid sudden market sell-offs.

- One-year lockup periods for most early participants to encourage long-term dedication.

- Gradual community unlocks to maintain liquidity while safeguarding price stability.

This approach reinforces sustainable growth, ensuring the MilkyWay network remains robust as adoption scales.

Challenges and Future Potential

While MilkyWay offers a compelling vision, potential risks warrant attention:

- Token Model Flexibility: The Foundation may adjust tokenomics in response to market conditions, creating uncertainty.

- Security Concerns: Phishing scams are a risk; the MilkyWay Foundation emphasizes it will never initiate direct messages or request sensitive information.

- Market Fluctuations: As a new cryptocurrency, $MILK may face significant price volatility post-launch.

However, MilkyWay’s modular liquid staking model positions it to capture a substantial share of the rollup economy. Its planned support for assets like INIT, stablecoins, and major cryptocurrencies (BTC, ETH) in 2025 enhances its long-term potential.

Discover: Haedal Protocol: Redefining Liquid Staking on Sui

Conclusion: The Value of MilkyWay and $MILK

MilkyWay transcends the role of a typical blockchain, embodying the future of decentralized trust, modular design, and efficient liquidity solutions. Powered by $MILK, the ecosystem creates alignment among developers, users, and investors, paving the way for inclusive DeFi innovation. As modular blockchains gain prominence, MilkyWay is poised to lead the charge, with $MILK as the catalyst for this transformative journey.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please conduct your own research before making any investment decisions.