Introduction

This article explores what ICM is, how it differs from traditional capital markets, and why Solana is emerging as the blockchain backbone of this new financial model. From meme tokens to AI-powered apps, ICM is democratizing finance and empowering global participation no banks or brokers required.

Traditional Capital Markets – How They Work

The Role of Capital Markets

Capital markets are the backbone of the global economy, enabling companies to raise capital for expansion, innovation, or debt management. They connect two main types of players:

- Investors with excess capital

- Enterprises needing funds

These markets include both primary markets (e.g., IPOs) where securities are issued, and secondary markets (e.g., stock exchanges) where they are traded.

Limitations of Traditional Capital Markets

While effective, traditional capital markets come with limitations:

- High barriers to entry (wealth, geography, legal access)

- Dependence on intermediaries (banks, brokers)

- Limited market hours

- Regulatory complexity

What Are Internet Capital Markets and How Are They Different?

Definition and Core Features

Internet Capital Markets (ICM) refer to decentralized, internet-native markets that enable instant, borderless investment and trading without the need for banks or brokers.

Core characteristics of ICM include:

- 24/7 global access

- Low transaction fees

- Peer-to-peer trading and fundraising

- Instant liquidity via tokenization

- Open to anyone with an internet connection

ICM vs Traditional Markets

| Feature | Traditional Capital Markets | Internet Capital Markets (ICM) |

| Access | Restricted by geography, wealth | Open to all with internet |

| Intermediaries | Banks, brokers | None |

| Trading Hours | Limited to business hours | 24/7 |

| Speed | Delayed settlements | Instant transactions |

| Innovation Pace | Slow | Rapid idea-to-token launch |

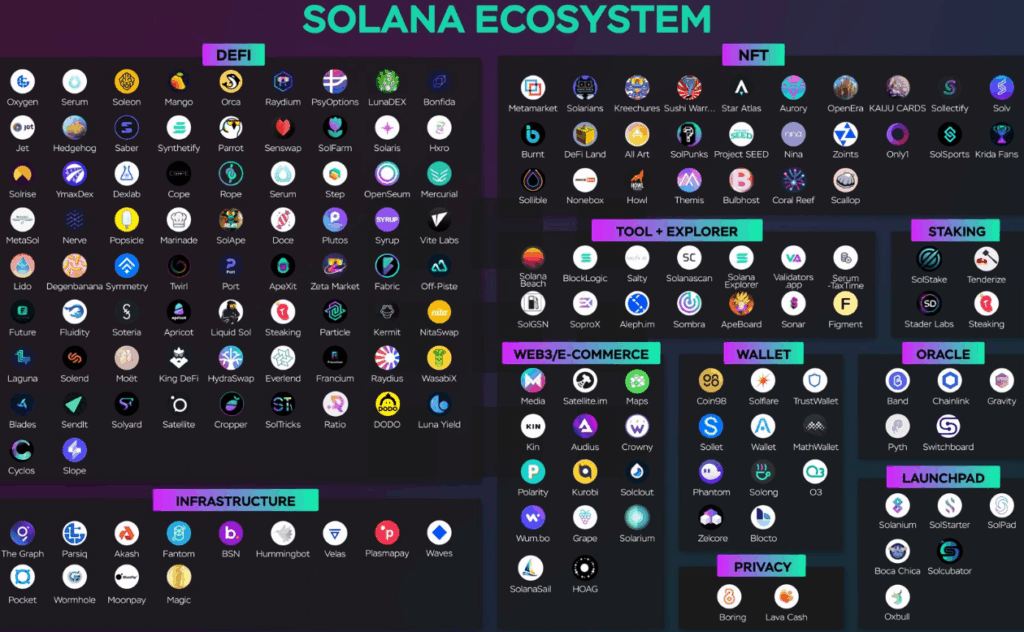

Why Solana Powers Internet Capital Markets

Technical Advantages

Solana is one of the fastest, most cost-efficient blockchains, making it ideal for hosting decentralized finance protocols that support ICM:

- Sub-second transaction finality

- Fees as low as $0.0001

- High throughput (65K+ TPS)

Ecosystem Fit for Builders

Solana supports a range of developer tools, SDKs, and launchpads that accelerate ICM innovation. Builders can:

- Launch tokens via smart contracts

- Raise funds directly from users

- Tap into Solana’s DeFi liquidity pools

Notable ICM Projects on Solana

LAUNCHCOIN

A crowd-funding token protocol: Anyone can launch a token for their idea. If the community believes in it, they fund it.

Discover: How to Launch a Coin on Believe: Builder’s Playbook Guide

DUPE

Just type “dupe dot com” before any product URL to discover a cheaper version token-incentivized comparison shopping.

BUDDY

AI-powered assistant for managing your X (Twitter) account with 8 tools tailored for creators.

FITCOIN

A virtual AI wardrobe app: create outfits, resell items, and share looks. Over 1M items uploaded.

GIGGLES

Short video app that rewards users with tokens for engagement. Rumored to have links to Google.

SUPFRIEND

AI-based tool to visualize and interact with your codebase, compatible with multiple programming languages.

Risks and Opportunities in ICM

Key Opportunities

- Access to early-stage investment opportunities

- Democratization of finance

- Rapid innovation in consumer finance, AI, and tokenomics

Key Risks

- High market volatility

- Potential for scam projects or rug pulls

- Limited regulation and due diligence

Internet Capital Markets: The Future of Global Finance?

Internet Capital Markets are redefining how people invest, fund ideas, and interact with money. Powered by blockchains like Solana, ICM offers speed, inclusivity, and creativity far beyond traditional finance.

But this frontier comes with risks. Success in ICM requires education, research, and community-driven accountability. For early adopters and innovators, the rewards could be transformative.