Introduction

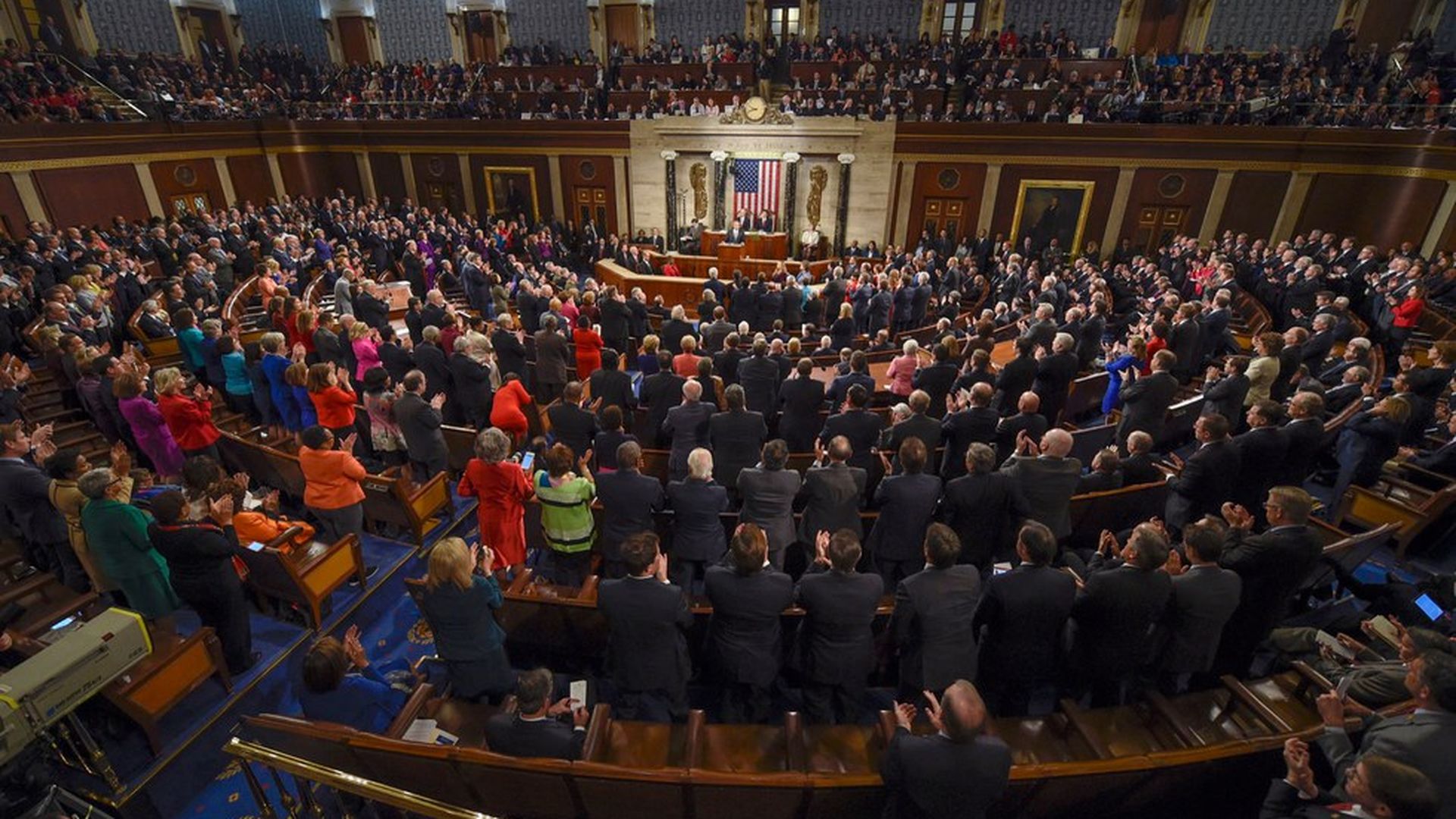

The U.S. Senate’s recent decision to repeal the IRS crypto broker rule signals a pivotal change in digital asset oversight. Advocates celebrate it as a boost for innovation, while detractors caution it could heighten tax evasion risks and weaken control. This shift reflects the ongoing struggle between clear regulations and advancing technology in the crypto sector.

Learn more about the case here

This piece examines the IRS broker rule’s origins, the push for its repeal, and its effects on businesses, investors, and the future of U.S. crypto regulations.

Understanding the IRS Crypto Broker Rule

Introduced via the 2021 Infrastructure Investment and Jobs Act, the IRS broker rule aimed to widen the “broker” label in crypto, mandating transaction reporting akin to traditional finance. Its purpose was to enhance tax compliance and transparency.

Yet, its expansive wording roped in decentralized exchanges (DEXs), miners, staking operators, wallet creators, and blockchain developers as brokers. This imposed heavy reporting requirements, like Know Your Customer (KYC) protocols and tax data collection, on a broad swath of the industry.

The Repeal: Why It Happened

The repeal stemmed from intense advocacy by industry players, crypto groups, and bipartisan congressional backing. Key drivers included:

Concerns Over Overreach

The rule’s wide net threatened to saddle developers and validators with impractical compliance demands.

Threat to Decentralization

Many blockchain setups lack centralized control, rendering adherence to the rule unfeasible for decentralized projects.

Lack of Clear Guidelines

Experts criticized the rule’s ambiguity, leaving firms unsure of their regulatory duties.

Political and Industry Pushback

Crypto advocates, business figures, and pro-blockchain lawmakers fought the rule, arguing it could choke industry growth.

Implications for the Cryptocurrency Industry

The repeal brings a mix of opportunities and hurdles for the crypto space. Here’s how it plays out:

Positive Effects

- Fostering Innovation: Easing regulatory burdens supports growth for blockchain startups, dApps, and non-custodial providers.

- Boosting Institutional Investment: Reduced uncertainty may draw more financial institutions into crypto markets.

- Protecting Privacy and Decentralization: Miners, validators, and developers avoid mandates to gather sensitive user data.

Potential Drawbacks

- Ongoing Regulatory Uncertainty: While this rule is gone, the U.S. still lacks a cohesive crypto regulatory framework.

- Tax Compliance Issues: The IRS might roll out new tax reporting methods, keeping pressure on the sector.

- Global Oversight Variations: Differing international rules could complicate cross-border compliance for crypto firms.

The Road Ahead

This repeal offers temporary relief for the industry, but it underscores the need for well-defined, fair regulations. Going forward, collaboration between policymakers and crypto leaders is vital to craft policies that balance innovation with tax compliance and investor safeguards.

Conclusion

The Senate’s repeal of the IRS crypto broker rule reshapes how regulators view digital assets. It alleviates fears of overregulation, though new rules may loom. For now, it cultivates a more innovation-friendly climate for blockchain and cryptocurrency adoption in the U.S.