The decentralized finance (DeFi) sector is witnessing a remarkable revival as Aave and Uniswap Surge, setting new records amid Ethereum’s (ETH) climb past $2,500. On May 14, 2025, Aave achieved a record total value locked (TVL) of $25 billion, while Uniswap surpassed $3 trillion in all-time trading volume. These milestones, fueled by robust whale activity, raise the question: Is DeFi entering a new boom? This article explores the achievements, market dynamics, and implications for the DeFi ecosystem.

Aave’s Liquidity Dominance

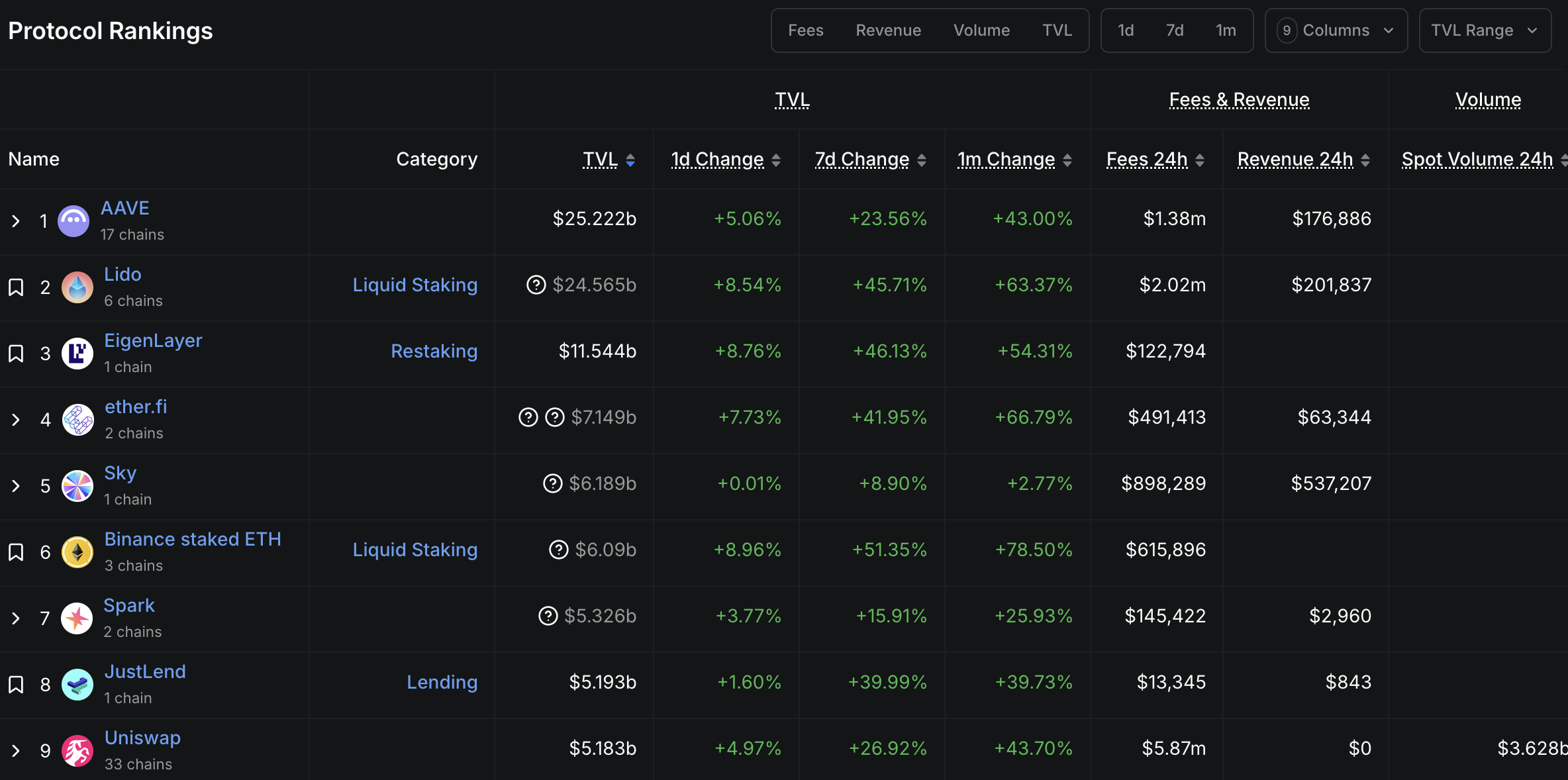

Aave TVL ranking. Source: DefilLama

Aave and Uniswap Surge as Aave solidifies its position as a DeFi leader. On May 11, 2025, Aave’s founder, Stani Kulechov, announced a TVL of $25 billion, capturing 21% of the DeFi market’s liquidity. This milestone outpaces competitors like Lido and EigenLayer, driven by significant deposits from large investors. Aave’s ability to support complex investment strategies, such as leveraged borrowing, underscores its appeal.

Whale activity further highlights Aave’s strength. A wallet linked to WLFI deposited 50 WBTC into Aave V3, borrowing 400 million USDC to acquire 1,590 WETH at $2,515, holding assets worth $15.11 million with a healthy 2.0 health rate. Another whale, nemorino.eth, purchased 3,088 WETH at $2,488, securing a $124,000 unrealized profit. However, not all moves were bullish—a whale borrowed 5,000 ETH from Aave on May 12 and shorted it at $2,491, reflecting divergent strategies.

Uniswap’s Trading Milestone

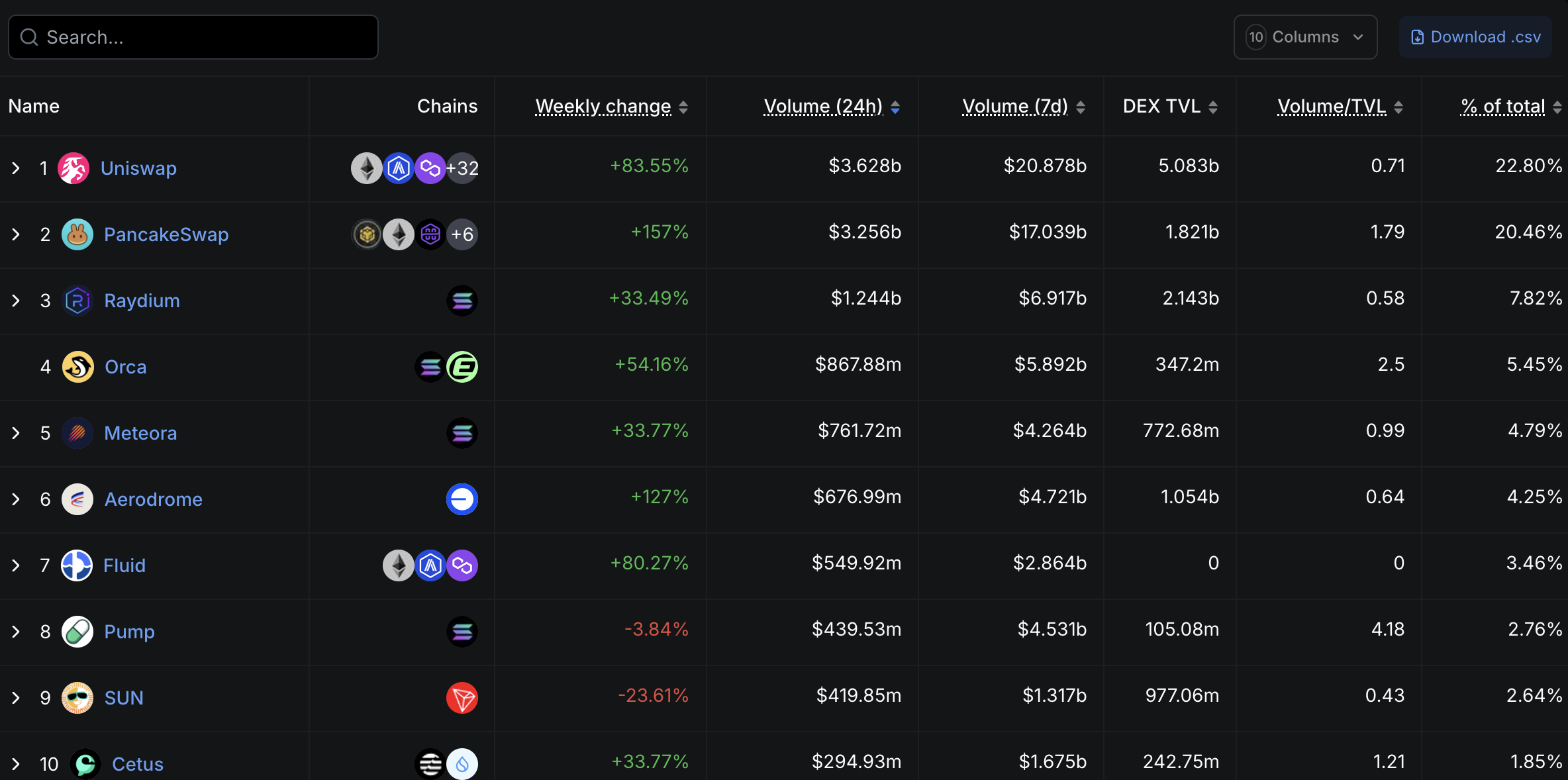

Uniswap Volume. Source: DefilLama

Aave and Uniswap Surge as Uniswap achieves a historic benchmark. On May 12, 2025, Uniswap’s all-time trading volume exceeded $3 trillion, with daily transactions surpassing $3.6 billion. This accounts for 24% of global decentralized exchange (DEX) volume, reinforcing Uniswap’s dominance. The platform’s automated market maker (AMM) model enables intermediary-free trading, attracting both retail and institutional users.

The surge in Uniswap’s activity aligns with ETH’s price breaking $2,500, a psychological threshold signaling market confidence. Uniswap’s ability to process high volumes with low costs and transparency highlights the growing appeal of DEX platforms in the evolving financial landscape.

Discover: Decentralized Finance (DeFi): How It Works and Its Promise

Whale Activity and Market Sentiment

The Aave and Uniswap Surge is closely tied to whale movements, reflecting bullish sentiment around ETH. Large investors’ accumulation of WETH near $2,500 suggests optimism, but short-selling by some whales indicates caution. These contrasting strategies signal potential volatility, as investors navigate ETH’s price fluctuations and DeFi’s rapid growth.

Online discussions amplify this sentiment, with community members celebrating Aave’s TVL milestone and Uniswap’s volume record as signs of DeFi’s resurgence. The influx of capital into these protocols underscores a shift from traditional finance to decentralized systems, driven by Ethereum’s robust blockchain infrastructure.

Implications for DeFi’s Future

The Aave and Uniswap Surge has profound implications for the DeFi ecosystem. Aave’s $25 billion TVL positions it as a liquidity hub, supporting sophisticated financial strategies. Uniswap’s $3 trillion trading volume highlights the scalability of DEX platforms, challenging centralized exchanges. Together, these achievements suggest DeFi is becoming integral to Ethereum’s ecosystem, with ETH’s price surge fueling further adoption.

However, volatility remains a concern. Divergent whale strategies and market fluctuations could lead to short-term corrections. Investors should monitor whale activity and broader market trends to navigate risks. Despite these challenges, the strong fundamentals of Aave and Uniswap, coupled with growing institutional interest, point to a sustained DeFi boom.

Conclusion

As Aave and Uniswap Surge, DeFi is experiencing a renaissance. Aave’s record $25 billion TVL and Uniswap’s $3 trillion trading volume, driven by ETH’s rise above $2,500, signal a maturing DeFi ecosystem. Whale activity reflects both optimism and caution, but the protocols’ milestones highlight their pivotal role in decentralized finance. With robust blockchain infrastructure and increasing mainstream adoption, Aave and Uniswap are poised to lead DeFi’s next chapter, though vigilance is needed amid potential volatility.